Both new and established businesses can help increase sales and improve customer satisfaction with a single choice:

by accepting Visa cards.

That choice carries significant benefits for both merchants and customers.

Both new and established businesses can help increase sales and improve customer satisfaction with a single choice:

by accepting Visa cards.

That choice carries significant benefits for both merchants and customers.

Accepting Visa helps limit transactions made with actual cash.

Visa card transactions are credited to your account almost immediately.

Visa's multiple layers of security protect your business and your customers from fraud online, over the phone and at point-of-sale.

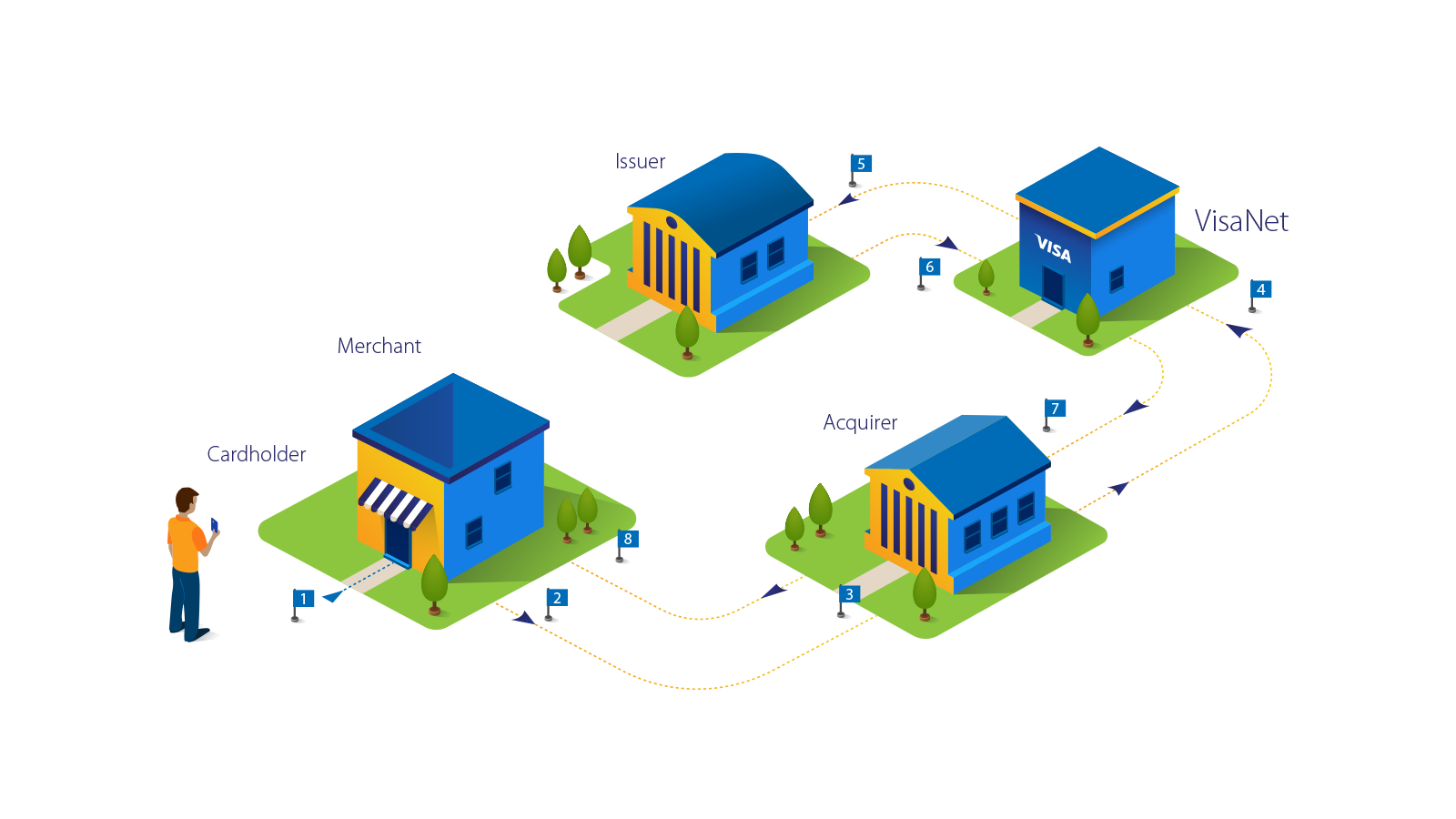

Visa card transactions are quick, convenient and secure. But what exactly happens during the process? Beyond you and your customer, Visa’s advanced network involves several different parties. Here is a quick glimpse of Visa in action.

The following definitions will give you a good understanding of who's who in the Visa transaction process.

An authorized Visa user.

A financial institution that issues Visa cards and maintains a contract with cardholders for repayment.

An authorized acceptor of Visa cards for the payment of goods and services.

The acquirer (financial institution) that initiates and maintains contractual agreements with merchants for the purpose of accepting and processing Visa card transactions.

An advanced network that acts as an authorization service for Visa card transactions, as well as a clearing and settlement service to transfer payment information between parties.

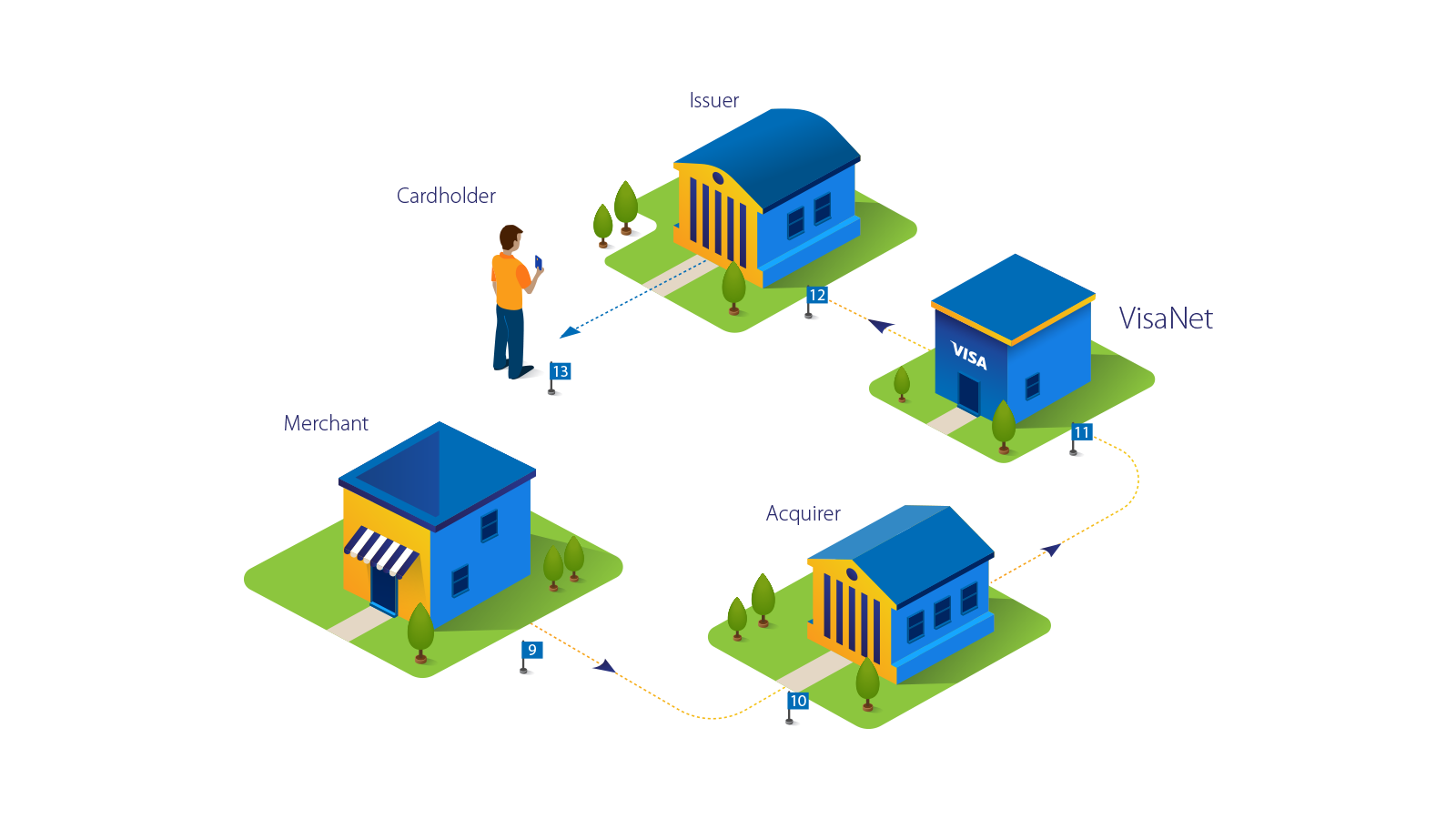

Processing a Visa card transaction involves two stages:

An electronic request is sent through various parties to either approve or decline a transaction.

1. Cardholder presents Visa card to pay for purchases

2. Merchant swipes Visa card, enters the dollar amount, and transmits an authorization request to the acquirer

3. Acquirer electronically sends the authorization request to VisaNet

4. VisaNet routes the request to the cardholder's issuer

5. Issuer approves or declines the transaction

6. VisaNet forwards the issuer’s response to the acquirer

7. Acquirer forwards response to the merchant

8. Merchant receives the authorization response and completes the transaction accordingly

9. Merchant desposits the transaction receipt with the acquirer

10. Acquirer credits the merchant’s account and electronically submits the transaction to VisaNet for settlement

11. VisaNet pays the acquirer and debits the issuer account, then sends the transaction to the issuer

12. Issuer posts the transaction to the cardholder account and sends the cardholder a monthly statement

13. Cardholder receives the statement and pays issuer

Once you decide to accept Visa cards, an Acquirer/Payment Processor will provide hardware, software and systems that work best for you.

One of the following nine processors will detail the options available and guide you in choosing solutions and systems that will work best for your business.

| Processor | Description | Contact |

|---|---|---|

|

Adyen (AMS: ADYEN) is the payments platform of choice for many of the world’s leading companies, providing a modern end-to-end infrastructure connecting directly to consumers' globally preferred payment methods. Adyen delivers frictionless payments across online, mobile, and in-store channels. With offices across the world, Adyen serves customers including Facebook, Uber, Spotify, Casper, Bonobos and L’Oréal. |

||

|

Chase Paymentech provides a wide range of payment solutions for point-of-sale and e-commerce merchants. Chase is Scotiabank's Merchant Services Partner. |

1-877-552-5533 |

|

|

Elavon provides end-to-end payment processing services to more than one million merchants in the United States, Europe, Canada and Puerto Rico. |

1-844-352-8661 |

|

|

First Data offers a complete range of innovative payment processing services. |

1-866-288-6184 |

|

|

Global Payments is a leading worldwide provider of payment technology services that delivers innovative solutions driven by customer needs globally. Global Payments is a merchant services partner to CIBC. |

|

|

|

Moneris is Canada’s largest provider of payment processing solutions for merchants of all sizes. Moneris offers products for in-store, mobile and online payments as well as installation and support services. |

|

|

|

Nuvei is the payment technology partner of thriving brands, providing the payment intelligence and technology businesses need to succeed locally and globally, through one integration. With the best merchant services out there, Nuvei's goal is to empower businesses to make the world their local marketplace. |

1-877-441-4729 |

|

|

Peoples Trust provides credit and debit card processing along with value-added products for any merchant. |

1-877-304-2084 |

|

|

PSiGate Merchant Services provides Merchant accounts, credit and debit card processing, and eCommerce transaction services for businesses in Canada and the U.S. |

1-877-374-9444 |

|

|

TD Merchant Solutions provides point-of-sale (POS) systems and solutions to meet all your business needs. |

1-800-363-1163 |

1 Commercial Tracking Study, TNS Canada